For all home-buyers, whether novice or seasoned, the 2021 housing market has been an interesting one to navigate.

“This year, [the housing market] decidedly shot way ahead of the economy, to the point where we saw this incredibly overheated market characterized by massive multiple offers, contingency waivers, price escalation clauses, and, in fact, record prices.”

One thing is for sure, home prices in 2021 have been rising steeply for most of the last year, and competition between buyers has been hotter than ever.. With inventory at record lows, and mortgage rates sitting near rock-bottom, it’s no wonder that 2021 has seen some record numbers. But as Summer has turned, people in the know have begun to wonder, how long can this seller’s boom sustain?

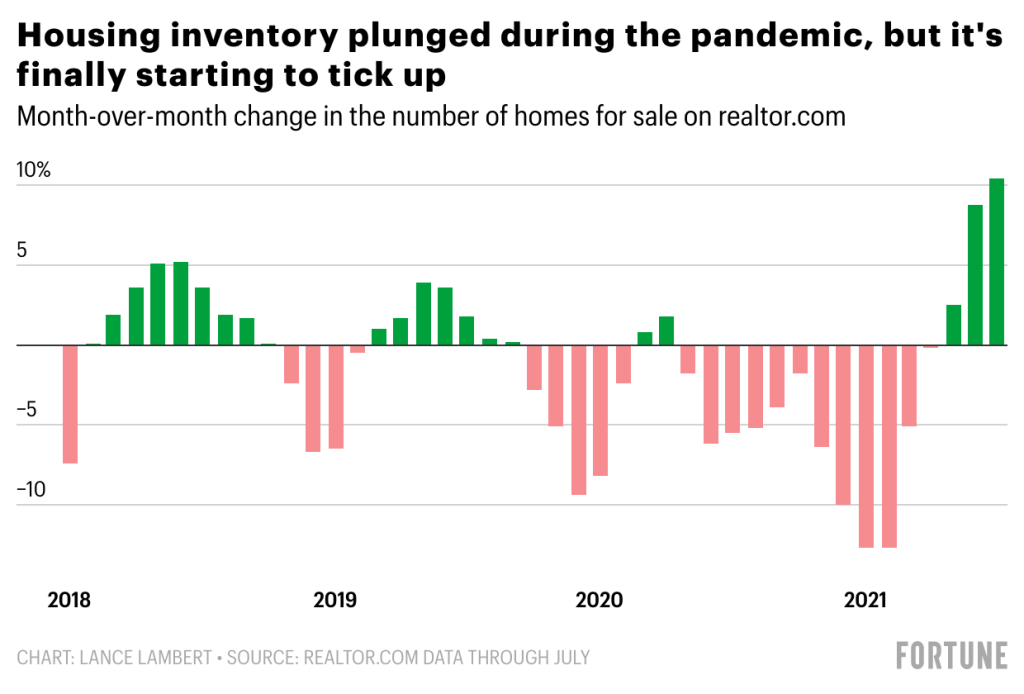

While the market is certainly hotter than it has been in years, there are some telltale signs that things are beginning to cool off. Per an Aug. 23rd report from Zillow, housing inventory numbers have begun to recover, meaning that there will be more homes available on the market, more options for buyers, and less competition per home.

Data from Realtor.com shows that the number of homes available for sale rose 10% across the nation in July alone, and 23% overall since the rock bottom of the spring. All the while, mortgage rates remain at near record lows, giving potential buyers the affordability and financing options they may need to make their next move.

All this data points towards a shift in the market for home buyers in the coming months. Relief most potential home buyers count as music to their ears.

What to Expect

It is no secret that it has steadily been a seller’s market over the last year. But with inventory on the rise as seller’s continue to come out of the woodwork, potential home buyer’s are likely to have more options, all while facing less competition from other buyer’s in the market. Forecasts from Zillow data analysts point to next year even being “more balanced” than what we have seen in 2021. When coupled with the already favorable mortgage rates and overall financing sector, increased inventory seems to be the necessary ingredient to swing the market back in favor of home buyers, bringing some balance and order back into play.

More Choices

Though this year was most readily characterized as hyper-competitive, data shows that buyers will have increasing options of houses to choose from when looking for their next home. This again is a shift more towards what we have come to know as the “normal market”, one where potential buyers are not competing so fiercely for the limited inventory of available homes we saw over the last year.

"...newly listed homes tend to be smaller in size than last year, shifting the mix of inventory toward smaller homes compared to last year. Looking at the single family home category alone, the share of homes having between 750 and 1,750 square feet increased from 30.6% in August 2020 to 37.0% in August 2021, while the inventory of homes having between 3,000 and 6,000 square feet decreased from 23.9% to 19.3%"

The Price

Experts do not believe that the rise in inventory is going to drive down the values on homes, however. The data shows really strong sustained growth, and merely a slowing down of the skyrocketing home values that we saw throughout most of 2021.

Recent predictions from CoreLogic’s home price forecasting report show that they expect a 3.2% increase in home prices before next June, with other reports floating expectations of prices rising by as much as 12% by July 2022. The good news is, however, that prices are rising at a slower pace than what we saw for almost the entire last year. Considering the 18.6% increase we saw from June 2020 to June 2021, this data still comes as a relief to potential buyers in the market. So for those looking at moving into a new home, the next few months will be primed for you to make your move.

A More “Normal” Offer Process

Anyone who put an offer in on a home within the last year knows, it has been a hectic process. Most of us by now have heard the harrowing tales of foregoing inspections, initial offers above asking price, and the competition to outbid potential buyers. All of these factors posed a real threat for home buyers, and drove some out of housing options that would have been feasible at other times in the market.

The forecast is far more temperate for 2022. With that cooling comes decreased competition for any given property, as well as returning to the norm of offers under asking price. This year to date, over half of all homes have sold for a higher price than what buyers originally expected to pay for a home.

Most experts agree with these predictions, estimating that the near future buying market will see a shift back to the pre-covid “normal” process, especially as more inventory continues to come onto the market in Southern California, as well as nationwide.

Mortgage Rates Still at Near-Record Lows; For Now..

Record low mortgage rates tempted many would-be homeowners to obtain a new mortgage (or refinance) while the prime rates were available. And though experts don’t forecast mortgage rates to skyrocket any time soon, they do see them trending upwards by the end of the next year.

For example, currently the 30-year fixed mortgage is hovering around 2.9%, but by the end of next year, both Freddie Mac as well as Realtor..com anticipate rates to tick back up towards 4% nationwide.

This rise in rates will be due in part to the potential decreasing of mortgage backed securities by the Federal Reserve, who have thus far been effective in absorbing rate volatility to the tune of $40 billion a month in MBS (Mortgage Backed Securities). If they do indeed take this spending elsewhere, it is possible we see more of a dramatic rise in mortgage rates within the next year.

To the home-buyer, that means waiting a year to lock in a rate could potentially lead to higher monthly payments.

The Suburbs Continue to Trend

The pandemic offered many potential home-buyers an opportunity to migrate away from higher priced urban centers, as many faced a “work from home” environment for an indefinite amount of time. According to multiple housing experts many are still working from home either full-time or within a hybrid model. This means that the ‘burbs are likely to remain a hot commodity moving into the next year.

Millennial Home-buying Trends

A large part of the “outskirts migration” has been driven by an increasing number of the millennial generation entering the home-buying market, to the tune of 4.8 million millennials entering their thirties this year alone.

Part of the demographic research into the buying habits of millennials show a heightened importance placed on quality of life and good schools for their children. So for most millennials there is a very real attraction to the suburbs of major urban centers.

Any way you look at it, the suburbs remain hot, attracting a diverse number of potential buyers.

Affordable Housing

As inventory levels continue to increase, part of that inventory expected to hit the market within the next year are smaller and more affordable homes. Trends show that smaller homes will continue to be listed in increasing numbers over the next year.

The availability of more affordable inventory coming to market will give home-buyers different options at different price points, which is great for first time buyers who aren’t in the market for a mid-tier or luxury home.

This lack of affordable inventory has been a keystone issue for first time buyers looking so far this year.

Now is The Time To Buy

Though price appreciation is looking to slow within the next year, experts aren’t exactly saying it will be more affordable to buy a house in 2022. Although home prices appear to be leveling off, housing prices are riding a near-record surge. That being said, it is unlikely to become any more affordable to buy at the end of 2022 than it is right now.

Ready To Buy?

Assessing your financial situation is often the first step when buying a home. Understanding how much you can spend on a down payment, as well as monthly payments, are crucial steps in finding the home that is the right fit for you and your budget.

Once you have an idea of what you are after, speaking with a trusted real estate agent who knows the local realty market is the next best step that you can take. From home discovery to closing day, a good real estate agent helps their clients navigate the many steps of the buying process.

Where We Go From Here

If you are considering a new home, whether it be your first time buying, or you are looking for your dream home, one of the first steps remains the same. Find a realtor who knows your local market, and who you can count on to have your best interests in mind.

When Your Ready, Reach Out and Take The First Step

Reach out to start the conversation, and we’ll start your new journey to home ownership today.